The Big Idea: A marketplace for legacy admissions

Legacy is a real advantage in applying to college, but not everybody wants to go to their parents' alma mater. What if we turned that inherited privilege into cash?

On March 12th 2019, federal prosecutors announced bribery and fraud charges against a range of celebrities, business leaders, and other scions of society. They were accused of bribing college officials to get their kids into top universities, including USC, Stanford, and Yale.

These people were wealthy and connected. Why did they feel the need to take this kind of risk?

One reason: virtually all of the most selective universities have gotten much more selective over the last 20 years. When I applied to UPenn (and was rejected after a stressful two months on the waitlist), they had an acceptance rate of over 20%.1 Today it’s 6%.

The stress of an increasingly competitive admissions environment has driven high-achieving parents and children insane. Entire lives are planned out to maximize admission to college.

At the same time, the rules of admissions are changing. Affirmative action is dead, international students face new obstacles, and schools are rethinking the basics of applications. Only one thing remains mostly unchanged: the children of former students (legacies) are disproportionately admitted to highly selective colleges.

But not every eligible legacy applicant actually applies to their family university. This status is a valuable asset; why should it ever go to waste? Introducing: LegacyMe, a way to buy and sell legacy status at top universities.

The market for college admissions

There is big money in getting kids into college. The admissions consulting market topped $10B globally last year, about the same as the global pet insurance and candle markets.

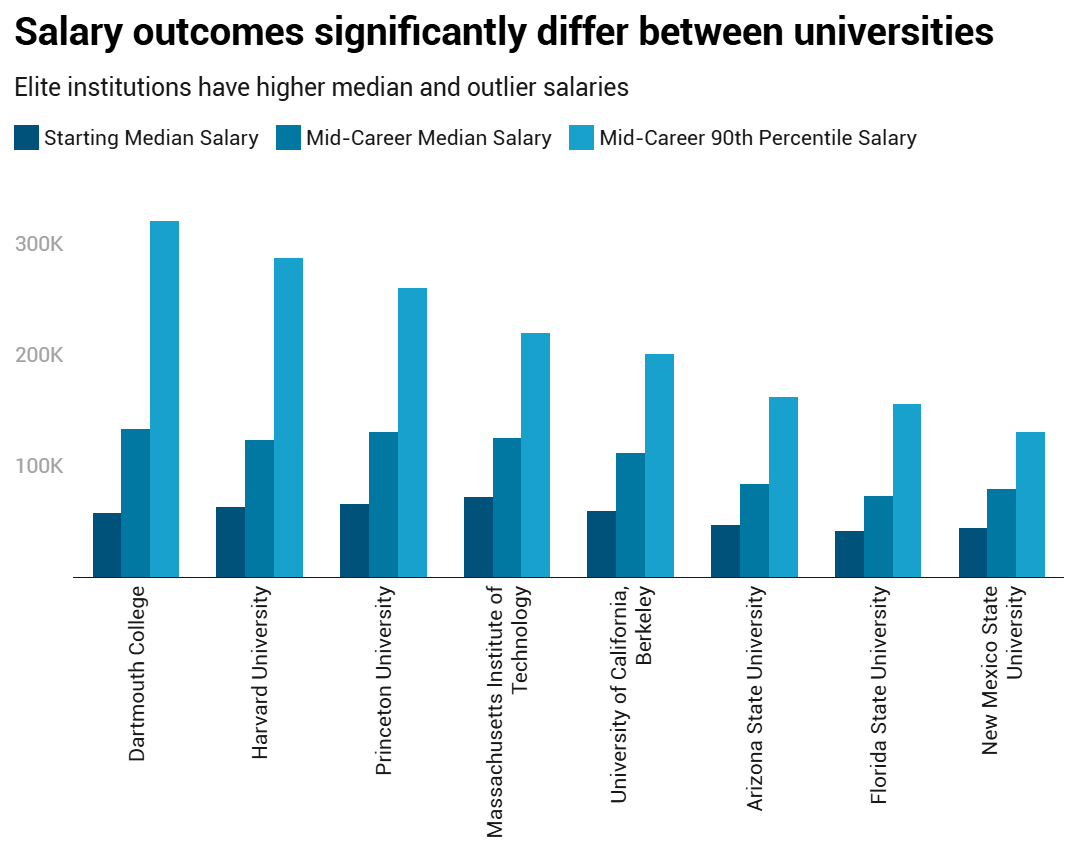

It’s not just a status game. While America is blessed with hundreds of fine educational institutions, top programs can offer graduates meaningfully different career opportunities and lifetime income. The salary difference between attending a mid-tier school and a top university like Dartmouth can grow to hundreds of thousands of dollars annually.

All of this emphasizes how valuable admission to a top college is, and how much the opportunity cost is when a Harvard-Princeton couple’s child decides to go to art school. I fully support the arts, but that’s two legacy spots that lots of people would kill — or pay a market clearing price — for.

Colleges really do admit legacies more

From the university’s perspective, it makes sense to give the children of graduates a leg up. Legacy students mean happy alumni who might donate or hire from the university.2

The exact advantage varies, from a closer look by an admissions officer to the equivalent of 160 additional points on the SAT. Court documents suggest that legacy status increases your chances of getting into Harvard by about 5x, to a 1 in 3 chance.

Legacy at Georgetown roughly triples your chances.3 11% of the Yale student body are legacy, as are 22% of Notre Dame’s. Before California banned legacy admissions, about 16% of USC students were legacy admits.4

This is a meaningful advantage that some families will never use. Why shouldn’t it go to someone who wants it?

Structuring a market for legacy status

Selling legacies is going to break some new ground. Let’s start with the easier part: market structure.

Legacies are well suited for auctions. Supply is unpredictable; it’s not clear how many kids will decide to put their legacy spot on the market. Demand will absolutely outstrip supply; wealthy families have already shown they’ll pay millions of dollars to secure a spot.

Across auctions, price discovery will absolutely affect demand across schools. A Yale and a Princeton legacy may not be perfect substitutes, but if the price diverges enough people might shop around. That means eBay style open auctions, where you can see the current bid for any legacy.

The price for any individual legacy would vary, but the intrinsic value is clearly there. The 20 year earnings premium for Princeton (#1 in US News and World Report) is around $481,000 more than the premium for NYU (#30). If we assume that cash difference is evenly split over a 20 year period, the present value of the Princeton admittance for an otherwise NYU-bound student is $299,716.5

Sure, you should discount that by your chance to get in. But there are also intangibles: the prestige of getting in, the networking opportunities, and the FOMO of not doing everything you could to get your child the best chance in life. It’s easy to imagine top university legacies approaching $1 million in a competitive auction.

To avoid over-supplying the market, the child relinquishing a legacy opportunity will need to sign a legally binding contract agreeing not to apply to the school. The standard contract should ensure the child selling their spot receives a cut — after all, it’s their asset we’re selling.

Now the hard part: how do you actually buy and sell a legacy?

A modest proposal for college admissions

Here’s the challenge: all of the reasons that universities do legacy admissions don’t apply if you sell the spot. It’s going to be a struggle to get admissions committees to accept a sold legacy, and especially difficult to convince the most selective universities. By design, these are not freely tradable assets.

The solution: legally adopt the winning child into the legacy-holding family.6

This instantly makes them fully eligible for any legacy programs without the need for any approval from the university. It may sound extreme, but isn’t it all worth it to send your (former) child to an Ivy?

I asked two actual lawyers if this would work, and they said that it possibly could (with some caveats).7 You’d need to emancipate the applicant, a legal process that makes them an adult in the eyes of the law. At this point they could theoretically go through the much simpler adult adoption process, which has a permissive “not contrary to public interest” legal standard. 90 days later, you’re officially part of your new family and ready to apply.

This is very antiquity-coded. 2000 years ago it wasn’t uncommon for important Roman families to adopt talented young people, providing them with the advantages of the family name. If it’s good enough for Augustus Caesar to succeed Julius, it’s good enough to get a BA in finance at Cornell.

To make this process simple, LegacyMe will have to productize the emancipation and adoption process. A slick app can automatically collect signatures, identify friendly judges, and handle the estate planning issues that arise for both families post-adoption. For premium users, LegacyMe can help draft a living arrangements agreement so the newly adopted child doesn’t need to move out of the house.

Practically there may be some other issues. Thanksgiving will be awkward, and you need to establish who the newly-admitted Columbia student goes home to for Christmas. It might be wise to set aside a therapy trust to pay for the psychological damage of this process. But that might be good advice for the students doing six extra-curriculars at 15 to get into Berkeley as well.

Wide scale emancipation and adoption for a better chance at admission to an Ivy League is, admittedly, not the ideal long-term solution. But by leveraging the inevitable media attention, LegacyMe may be able to force universities to see the writing on the wall and come to the table.

The legacy transfer system

The better end goal for LegacyMe is an official partnership with top universities to establish the Legacy Transfer System (LTS).

The LTS allows seamless transfer of legacy status within the common app, securely verifying that a legacy has been purchased and transferred. In exchange, universities receive a service fee for legacies transferred via LegacyMe.

Take Harvard’s class of 2027, which had approximately 650 legacy applicants.8 If Harvard required a 25% cut of sales made via the LTS, an average sale price of $300,000 implies a potential annual income of up to $48,750,000. Even with a $50b endowment, that’s a serious incentive to buy in.

Of course, the fact that universities are participating would have second-order impacts. Legislators in nearly every state have proposed banning legacy admissions, and major markets for LegacyMe like UCLA and Stanford have already been impacted by a legacy admissions ban. The movement against legacy admissions would only accelerate after applicants learn universities are literally selling a better chance to get in.

In response to concerns over inequality, universities could earmark a portion of their earnings from the LTS system towards auction credits for low-income students. These credits can be used to bid on legacy admission spots that they otherwise couldn’t afford. This might just have the effect of raising prices without actually improving access, but the press release from the university will look amazing.

Middle class families that fall over the income threshold shouldn’t be left out either. Why can’t you finance a payment on LegacyMe, paid for with a ISA-type percentage of salary over a 40 year career?9

Assume you capture the average upside from attending a higher tier university as a series of cash flows. A spot at Princeton bought for $200,000 has an expected 7% IRR over 40 years, with high upside for the top of the class. Surely an enterprising private credit firm can model the likelihood of a student getting in with legacy status as part of the underwriting process.

These investments are ripe to be securitized into Admissions Backed Securities (ABS), allowing investors to buy cash flows from these loans. The interesting financial engineering comes from how you slice it; the boring path is to do traditional mezzanine debt with different interest rates.

More exciting is creating securities based on characteristics of the legacy admittees. Early investors can buy into tranches based on SAT scores and grades to get risk exposure to college admissions. After admission, loans can be repackaged based on university, major, or even by decile of earners in the pool over time.

There is a natural buyer for these assets: university endowment funds. They have a long term outlook, invest in private markets, and can cross-reference investments in their students with their admissions and academic data. Best of all, this lets universities diversify: if Harvard students seem to be underperforming, their endowment fund can invest in ABS’ from a basket of other top universities like MIT, Princeton, and Columbia.

In a time where alumni donations are declining, universities will jump at the opportunity to pivot to an asset based strategy. The personal IPO is happening, one way or another.

Official idea rating

2/5. The pressure of getting into an elite college is already destroying the mental health of a generation of ambitious young people. Adding additional financial pressure may not be the best way to fix it. The campaign against LegacyMe would be vicious. Even with payments, universities would be reluctant to officially sign on; Dartmouth doesn't want a reputation for their students all buying their way in.

But the culture of credentialism combined with stagnant class sizes will continue to drive intense competition for limited spots. Parents aren’t going to give up on finding a way to get their kids any advantage they can. The open question is how far they’ll go to find creative ways to do it.

I bet at least some families have formally adopted a niece or nephew to help them get into university. If you’re a college admissions professional reading this, let us know if you’ve seen this in the comments.

In retrospect, 20% actually feels like a very high acceptance rate — which shows how crazy admissions standards have gotten in the last 15 years

The effect of legacy admissions compounds over time: a multi-generational Yale family is highly likely to be involved in the university. And in a world where universities are directly ranked on the percentage of admits that accept, legacy is a strong signal that you’ll actually take the offer if given.

There are some confounding variables to legacy admissions. Legacy students are likely to have better academic support, test prep, and possibly college coaches to boost their chances independent of the direct advantage. It’s not all the legacy advantage, although it clearly helps.

There’s also a separate path called a development admit, where a student is (informally) admitted in exchange for a large donation to the school. This doesn’t require that the parents be alumni, but in practice it seems to usually be the case. The rumored cost for a development admit is at least $10 million dollars. This is out of range even for many of the wealthiest families, driving demand for lower-cost solutions.

Using a 5% discount rate

There are No Dumb Ideas

I should note that neither of these lawyers were family lawyers. They were actually more excited about how this mechanism could allow for creative estate and trust planning.

Harvard does not release exact numbers for legacy applications, but you can approximate. 12% of students are legacy, with a 36% acceptance rate. With 1,942 admitted students, that implies approximately 650 legacy applicants.

Income share agreement: an agreement to pay a percentage of your salary over a certain amount.

As an admissions counselor, thank you for this. Incredible stuff.

Love it. And if we're breaking the sanctity of admissions in education, the not-so-ridiculous corollary of this theory is for universities to take their existing "back door" admissions to the front. I.e., most/all universities have a "We'll accept your child if you donate $[X]m" policy managed by a handful of college admissions "power brokers." Why not just have a landing page that auctions off seats at the top universities on a rolling basis?

Thankfully, there'd still be a market for the above -- the price would be a fraction because it lacks guaranteed admissions (and adoption, mental duress, habitation challenges, etc., lol).