The big idea: Turn lobbying into a high-stakes financial market

A big idea that aligns incentives and sort-of encourages bribery

I am not a crypto guy, but I’ve been fascinated by the experience of Siqi Chen, a serial entrepreneur on X. He recently went viral with this post:

Essentially someone sent Siqi a bunch of crypto tokens called $MIRA, publicly bid it up, and very quickly his memecoins were theoretically worth $18 million dollars.

This seems to have been an extremely stressful situation for him. Speculators jumped in as he tried to find a way to sell without crashing the price and making people mad at him. He ended up using these coins to create a foundation that’s raised over $1 million and counting for rare disease research, so I’ll call it a win.

What stuck in my head was the idea of sending somebody a newly created asset, then giving it value afterwards. What if you could do this with something other than a memecoin? What if this could become a way to do political lobbying? Introducing: PoliFutures, smart crypto contracts that only pay out if a specific policy change happens.

How would something like this work?

Crypto-based prediction markets, like Polymarket, let people trade bets on future events like elections. New contracts are created when two people take opposite sides of a bet— if you think there’s a 40% chance of an event, you can buy “yes” for $0.40, while someone else (“the counterparty”) buys the other side — “no” — for $0.60. The $1 contract is now created, freely tradeable, and the correct side gets $1 when the event resolves.

But we don’t need a counterparty. Imagine that an interest group wants to hire a lobbying firm to do something — I don’t know, McDonald's wants to pass a law that makes it easier to sell chicken nuggets (The McNuggets Act of 2025). Today, they spend ~$2 million dollars per year on a set of lobbying firms. I don’t know how they do performance based payment, but I’d assume the lobbyists get paid whether or not the McNuggets Act gets passed.

Instead, McDonald's can take $1 million, take both sides of the contract, and create 1 million yes contracts and 1 million no contracts. They then send their lobbying firm some fraction — say, 500,000 yes contracts.

Uh, why would they do it that way?

This is pay for performance! If the lobbying firm succeeds and the McNuggets Act is signed into law, they get $500,000. If they don’t, the holder of the other side of the contract — McDonald's — gets their $500k back when the contract resolves to no.

This format unlocks a new approach: what if you learn from Siqi’s experience and start sending Yes contracts to people’s crypto wallet unprompted?

Influence on influencers

Lobbyists take lots of approaches to influencing policy, but one of the most popular is targeting “key influencers” — people that politicians pay attention to. This can be anybody from donors to family members, religious leaders, or influential writers. The goal is to have politicians hear your ideas from people they independently trust and respect.

I think paying these people directly would be sort of bribery? Or at least it would look really bad — giving someone a check or a bag full of cash for influence is a tough news story. And you can’t really force them to take an action in exchange for the money? It goes out and you just sort of hope for the best.

What if your lobbying firm proactively found these key influencers and sent 20,000 of their yes contracts? Suddenly, these key influencers are very interested in pulling their contacts to help the McNuggets Act pass. Or what if they looked more directly — just send the crypto tokens directly to the representatives in question. If they vote yes, they get the money. If they vote no, the contract expires worthless.

Isn’t that just bribery?

Well...the current jurisprudence is actually sort of vague about that. Over the last 15 years the supreme court has narrowed corruption legislation to (I am not a lawyer) essentially require an explicit promise for action in exchange for the payment1. You’re sending them the token proactively, with no promise needed that they’ll vote for anything. Sure, they get paid if they take the action — but the actual asset you transferred was sent without any promise of an action from the politician.

I guess having 100% of the value be driven by the decision does feel dicey. Maybe it’s important that the token has value independent of their action — have it be just a gift.

They need to create some prices

So how does McDonald’s solve this? Simple — create a market for these tokens.

Once there’s a price set, that crypto to the wallet has a value — in this case, $0.30 per contract. You can send our stakeholders $3,000, with the promise of it being worth $10,000 if it resolve to yes. Maybe a stronger argument to the court!

This also gives some ability to set the value of the asset; Congresspeople have to report gifts over $480. If you set the price to $0.01 before the market is discovered, you could send 47,999 contracts (worth, if triggered, $47,999) without triggering disclosure.

Beyond legal fights, there’s independent reasons to do this:

McDonald's can get accurate information

Prediction markets, in theory, are a tax on bullshit. With a liquid market of bettors, the price should converge on the actual chance of something happening. McDonald's wants to know how likely they are to succeed at this — the market existing allows for them to track their success in pushing the bill.

Provides liquidity for risk reduction

Both McDonald's and our lobbying firm can hedge their bets by selling. If there’s a 30% chance of the McNuggets act passing, the lobbying firm may opt to sell some of their tokens to de-risk their work. Conversely, if McDonald's thinks that the No side is overconfident they can sell some of their No tokens to make back their lobbying fees.

Create policy entrepreneurs

Some people may have influence on the passing of the McNuggets Act who a lobbying firm can’t identify. If they allow anybody to buy into the market, they’ve decentralized the incentives to make this change happen. You can imagine independent lobbying firms popping up, buying tokens for causes they feel they can influence — sort of like a lobbyist Hindenburg Research (RIP).

How can you create the market?

You go to an exchange! McDonald's can take their 1 million paired tokens and slowly auction off yes/no pairs or sell into the market. When their tokens run out, new traders can create new yes/no pairs if they find an agreeable price.

But McDonald's still has the 500k no tokens. If they want to start manipulating the price, they can also sell just the no pairs, creating a supply/demand mismatch in the market. Without a matching yes pair, the number of no tokens would be higher — driving the price of no down and yes up.

What happens with the no side?

There’s one big flaw in this — for contentious issues, all of this could be reversed. What if PETA is against the McNuggets Act, and ready to lobby against you? They could buy a bunch of no contracts, give it to their lobbyists, and suddenly McDonald's is financing their opposition.

McDonald's…can’t really stop this directly. But it’s not free for the No side to do this — if the “No” price is $0.60, they need to front 60 cents for every dollar they can make. That’s a lot of upfront capital for a nonprofit! Would the board of Rainforest Action Network really sign off on their finance team gambling on a bill?

Maybe not, but I wonder if this could become a new asset class for hedge funds — financing contracts for advocacy nonprofits, then taking a large management and performance fee. The hedge funds may not care about animal rights, but they’d be happy to help save the rainforests for a 70% return. Nonprofits can financialize their lobbying power, essentially selling their ability to make policy changes to the market.

And then there’s pump and dumps

The scourge of cryptocurrency is the pump and dump — a hypeman sells their cryptocurrency (which they own 80% of) as the hot new thing, drives the price up, and then sells as much as they can before the price falls to 0. If you happen to be really good at getting attention, this can make you something like $50 billion dollars.

What would happen if boring things had markets? People would want to buy contracts, create the impression that the McNuggets Act was on the verge of passing, and then rapidly sell their contracts for a nice profit. We could see a whole misinformation industry be created, designed to trick people into having opinions and FOMOing into bets on boring regulatory questions.

Another factor: insider trading

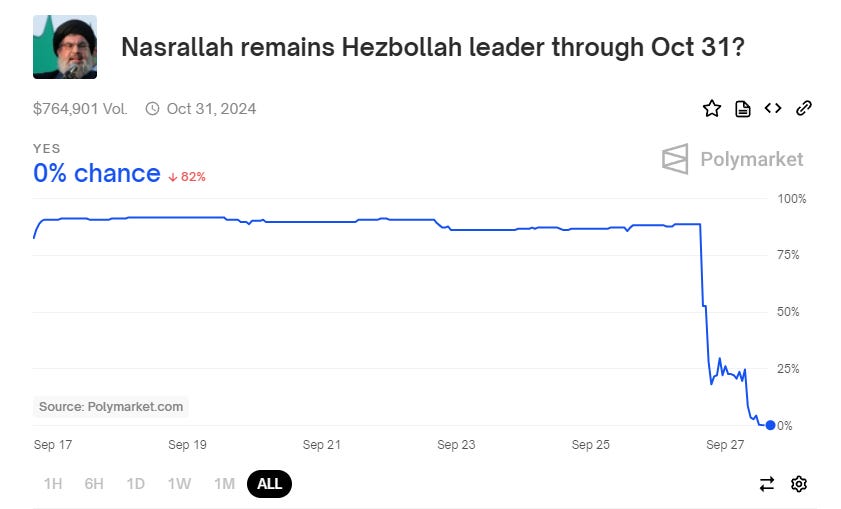

One of the really interesting things on Polymarket this year was the assassination of Hezbollah leader Hassan Nasrallah. There’s some circumstantial evidence that there was insider trading — someone bought a bunch of “no” contracts on him remaining Hezbollah leader before the news of his death was widely reported.

Note the kink in the drop from 80% to 25% as the rumor spread

Insider trading could become a whole new wealth generation activity for Senate staffers, clerks, and interns who can get a slight information advantage.

The unending spirals of where this could go

First off, why should McDonald's front the $2m? They could easily take out a loan, with the remaining tokens acting as collateral. The banks could then package these loans into Collateralized Debt Obligations, which return a profit based on a distribution of likely prediction market outcomes. They can tranche these contracts up, offering the AAA piece to pension funds — who then now have an interest in supporting the lobbying outcomes that backstop their returns.

Futures markets will spring up and leveraged ETFs will let 401ks bet on baskets of liberal or conservative outcomes. As this becomes a trillion dollar market, the entire advocacy industry will experience a boom while prediction market finance becomes the hot new MBA exit.

Eventually this can become a major part of the balance sheet of banks, and the global economy will rest on the back of the McNuggets Act. Congress better get to voting.

Official idea rating

A reluctant 5/5. I could think of ways for this to continue spiraling forever; it may destroy all social trust and our politics, but in a society of increased gambling and financialization it may be inevitable. Maybe this is the next step for Polymarket — or maybe it’s already happening, and the McNuggets act is soon to be the cornerstone of the global economy.

Snyder v. United States (2024) requires there be a quid pro quo exchange and specifically legalizes “gratuities” of payments that happen after an official act. I am not a lawyer though!

Would you see a way to reverse the players? How could an NGO do something similar to finance social work? Something like a social bond idea.

wen No Dumb Ideas coin?