The big idea: Hobbies through acquisition

After a COVID-driven boom in hobbies, billions of dollars in equipment is sitting in America's closets. What if there was a better way to rehome them?

I took a few hours this week to clean out my closet and sell my unused junk on Craigslist. It’s nice to make some money and create some space, but it’s also a brutal reminder of abandoned hobbies: a flight simulator joystick, an old VR headset, an Orangetheory heart monitor, an entry-level coffee roaster.

I keep feeling like something gets lost in the transaction. I’ve put dozens of hours into each of these hobbies; when I sell the equipment piecemeal, that all gets lost. Months of classes turn into a slightly sweaty Orangetheory band (don’t worry, I cleaned it).

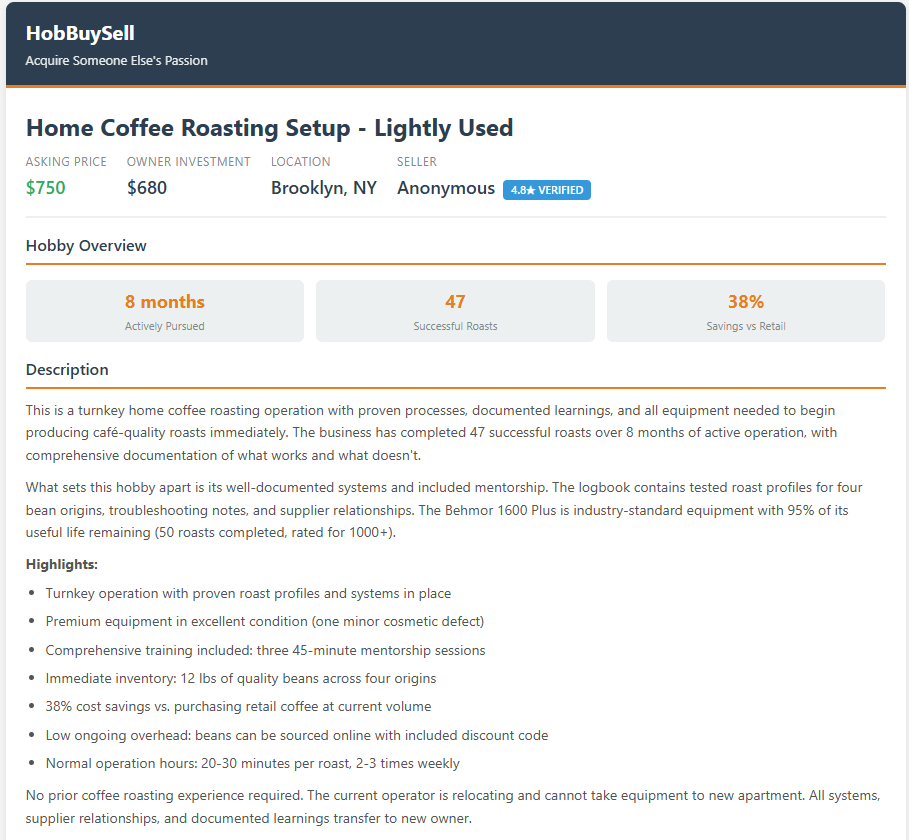

People buy and sell businesses all the time through sites like BizBuySell. Why can’t you buy and sell an entire hobby when it’s ready for a new owner? What’s stopping us from creating HobBuySell?

HobBuySell: The Hobby Acquisition Marketplace

Imagine you’re interested in roasting coffee. In the past, you might have agonized on the internet, looking at hours of content to decide on your first roaster. $300 is a lot of money, so you fall into analysis paralysis as you try to understand exactly how often you want to do Ethiopian light roasts and which machines give the best range. You end up researching it for 2 months before actually making a purchase, then giving up on it a few weeks later.

Instead, you log onto HobBuySell and find my listing for a full acquisition of my roasting hobby. Not only does it come with a full suite of equipment, inventory, learnings, and relationships with suppliers (my order history from Sweet Maria’s), it comes with an earn-out period where I help transition you into the hobby by doing a few roasts with you. Once you’ve fully taken control of operations, I can finally disengage, knowing that my hobby is in good hands.

The exact knowledge transfer would vary by hobby, but is a key part of the value proposition: if buyers were comfortable just buying used equipment on Craigslist and watching YouTube, they would. The package of equipment + knowledge is worth more than the sum of its parts.

Of course, it’s not as simple as that. Earn-outs need to be performance milestones: a buyer might require three successful loaves of sourdough baked before full transition is considered complete.

HobBuySell’s business model is pretty simple: a commission on the transaction value, plus a listing fee for premium placements. Their fee can include an escrow service that releases funds as performance milestones are hit, verified through templated contracts.

The value of the platform goes beyond matching buyers and sellers; after submitting an LOI1, HobBuySell can help facilitate and verify a memorandum showing the health of the equipment, an explanation on why the seller is giving up on the hobby, and receipts from suppliers to show they’re in good standing. This process is key to a clean transaction — you don’t want lawsuits over a hobby marked as “beginner friendly” being more challenging than expected.

The real value is building trust in an inherently risky transaction, facilitating a vibrant market where only an inefficient one exists today. For the first time, people will be able to really transfer everything that comes with a hobby, lowering the barrier to entry and the barrier to exit.

Entrepreneurship through acquisition has paved the way

This kind of resale market already exists in one big market — businesses. Very broadly, entrepreneurship through acquisition (ETA) is the idea of buying an existing small business as a jump start to entrepreneurship. ETA can be anything from the classic “buying an HVAC operator” to more esoteric businesses you find on BizBuySell (my favorite: goose abatement).

A lot of boomer business owners are retiring. While private equity will get first dibs on a lot of these small businesses, a meaningful share will end up with a smaller (but engaged) operator. MBA programs and ETA podcasts like Acquiring Minds and Acquisitions Anonymous are proselytizing to a new generation of potential buyers, removing barriers to entry and sharing knowledge. The result is a wave of highly educated and well-capitalized buyers descending on small companies around the country.

These businesses actually have a lot in common with hobbies. Many hobbies have high capital expenditure to get started; a new instrument or grill is easily hundreds of dollars, and that number only compounds as you get deeper. Product-market fit is a challenge for both — you might spend thousands of dollars only to realize that you really aren’t that into beekeeping.

When these hobbies start to fade, the initial investment in time, equipment, and knowledge goes to waste. At best, you put the equipment on Craigslist — which is sort of like building a lawn care service business, then retiring by selling the lawnmowers. You’ve sold the equipment, but lost the customer relationships, operational knowledge, and the brand.

In hobby terms you’re losing the hours spent researching which equipment to buy, the knowledge of troubleshooting your gross first batch of beer, and the ideas for woodworking projects that never got done. The whole is more than the sum of its parts, and people would be willing to pay for it.

There’s a lot of economic value from transitioning these hobbies. Let’s look at the numbers:

The Bureau of Labor Statistics estimates an average spending of $1,057 for pets, toys, hobbies, and playground equipment in 2023.

If we assume 25% of this category is hobbies, that’s over $35 billion in annual spending.

Per the St. Louis Fed, after a COVID-driven 41% increase in spending on hobbies between 2019 and 2021 there was a 16% decline in 2022.

That means 2021-2022 alone led to a potential $5 billion drop in hobby spending, presumably driven by people abandoning candlemaking after return to office picked up.

It seems inevitable that the COVID hobby boom and bust left mountains of abandoned hobbies. But hobby spending is still well above its 2010s norms — all of that trapped enthusiasm is unrealized value waiting for a liquidity event. Let’s give it one.

Resale might change how hobby adoption happens

One key dynamic in ETA is that many acquirers are business…if not agnostic, then open. Typically an acquirer is mostly focused on the economic characteristics of the business — cash flow, EBITDA, revenue growth, etc. It doesn’t matter so much whether it’s a cleaning company or a sandwich franchise as long as the numbers look good.

Most hobbies don’t work that way today. Discovery mostly happens through friends and family, social media, or just browsing Reddit late at night. HobBuySell opens up the possibility of hobby-agnostic acquisition — people who are looking for a change of pace and a purpose in their life, and willing to jump into the one that seems best.

There’s actually some real advantages to being hobby-agnostic in your search. It takes time to figure out if a hobby is in your budget, compatible with your lifestyle, and if there’s a local community. The clarity of the full cost of entry and ramp up with the seller means you can eliminate whole classes of hobbies that don’t make sense with your lifestyle. That means cleaner sorting, better information, and happier hobbyists.

Of course, to make a truly agnostic hobby acquisition, there will need to be some new metrics. These would evolve, but could include hours of weekly engagement, compatibility with lifestyle, local community size, and resale difficulty index. At least at first.

A structured market for hobbies might have some negative side-effects

A big part of the ETA ethos is financing an acquisition. If hobby acquisition is to reach any scale, it’s going to need financial infrastructure.

A common financing tool for ETA is an SBA 7(a) Loan, which comes with a government guarantee. SBA loans typically come with longer payment schedules, better interest rates, and down payments as low as 15%.

But hobbies have value too! An SHA (Small Hobbies Administration)2 could guarantee financing to help acquire hobbies. For someone getting started in beekeeping, the estimated $800 cost could be made up of a $120 down payment and a $680 loan. This would dramatically lower the barrier to entry for these hobbies, bringing in a wider range of incomes and making large scale hobby trading feasible.

Now, you may be asking why the government would guarantee loans to buy a pottery wheel. I can give you some intangibles like hobbies make you healthier and happier, but there’s a financial reason too — a robust marketplace for hobby acquisition means hobbies become tradable and priced. While cashflow is certainly easier to value, the ability to resell the hobby enables repossession of a failed acquisition.

Hobbies are already mostly standardized at the entry-level and become more specialized as you advance. One of the interesting side effects to financialization is the drive towards conformity; lenders will prefer legible sets of assets, so esoteric sets of equipment will be harder to sell than clear “entry-level, mid-level, advanced-level” style sets.

This is a massive opportunity for the hobby providers that become the standard, but may take a bit of the joy out of the process.

A financial motive might also professionalize hobbies a bit

It’s likely real capital would enter the market over time. Our coffee roasting example might attract an entrepreneur that comes in, vertically integrates an espresso making hobby, and cuts some of the costs through bulk bean purchases before bringing it back to market at a 30% price hike. This type of hobby flipping might be suitable for a search fund, with MBAs raising capital to start a gardening roll-up across vegetables, flowers, and landscaping.

You can even imagine specialists, like a soapmaking guy that buys up old soapmaking kits and resells them with improved education. These small-scale consolidators can begin vacuuming up niche hobbies, becoming small-scale aggregators. Supporting businesses, like hobby brokers, would spring up to supply a growing demand for acquisition.

This opportunity would attract institutional capital sooner or later. Big private equity firms might roll up 2,000 woodworking hobbies, implementing standardized processes and standardizing lumber suppliers to an (also PE-owned) firm. With nationwide data, arbitrage opportunities will abound. Trucks full of knitting yarn in Des Moines will be sent down to San Francisco, chasing the arbitrage between hobby valuation multiples.

Hopefully HobBuySell can emulate the old days of Etsy for at least a little bit before it’s full of full-time hobby flippers.

Official idea rating

3.5/5. This would be great if you can solve the cold-start problem, but until its culturally normalized people will have a hard time adjusting. Handoffs will go poorly, scams will hit the platform, and most markets will struggle to balance supply and demand. That said, if Airbnb was able to do it then HobBuySell can probably figure it out.

Still, the friction of starting and exiting hobbies probably keeps a lot of people from trying new things. How many people would try to learn an instrument, knit a sweater, or grow some plants if they knew they could resell the whole thing if it didn’t work out?

So many people today are seeking ways to spend their time that isn’t endlessly scrolling their phones. A hobby marketplace makes total sense, both as a way to reduce waste and as a way to help bring new hobbies into the lives of the bored.

The challenge is always going to be balancing monetization and exploration. It’s only natural that people will see profit-maximizing opportunities in your rock climbing equipment. But it’s not necessarily bad — a liquid market means the cost of starting and exiting a hobby will be lower than ever.

And it’s a nice idea: your sourdough starter lives on. Your woodworking set stays together. A failed hobby becomes a seed investment in someone else’s engagement. At least until they resell it a few months later.

Letter of Intent

Ok, maybe we won’t get a new agency to finance hobby loans. But specialized lenders could certainly see the value in this.

I had a related idea a while back for a business pitch I call “The Dad Garage”.

Basically, you have a bunch of aging urban Millennials who are too housing-crunched to really have space for all their hobbies, right? We’re all living in apartments, and don’t have garages or basements, let alone the real freedom to fully customize our spaces for certain applications.

Enter “The Dad Garage”. Buy up spaces in urban markets — especially former restaurants, which are already set up for safely handling a lot of hazards — where these guys can go on the weekends and have their hobbies. Rent them onsite storage. Have a modular business setup — maybe in CT there’s a lot of guys who wanna do wood fired pizza making, while in AZ they’ll want a kiln for pottery or whatever.

Membership fees will include a la carte insurance fees based on activity. Customers can also over time become instructors. Teach hobby classes, etc.

Maybe you even have a play area for kids — dad can take the kids out to The Dad Garage on Saturday and hang out all day, giving mom time to her damn self. And as Patrick Wyman’s podcast “The Pursuit Of Dadliness” noted, dadly moms are perfectly welcome too!

Every location will have a janky old CRT TV airing the local football game — assembling it from salvaged parts can be the core hurdle of the franchise application.